Buyouts

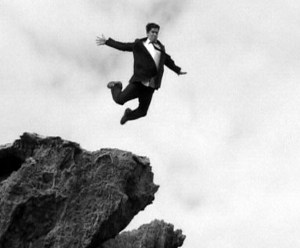

“It’s a game of chicken”—Ted Gullicksen

If you negotiate a buyout with your landlord, you don’t want to be the person plummeting off the cliff. That is why we will help you if you decide to take a buyout.

What are buyouts?

A buyout is simply a negotiated settlement before litigation in which the tenants are paid money to vacate and all of the parties release all of their rights. In rent controlled jurisdictions like San Francisco, landlords often offer tenants money to vacate their unit and waive any future tenants’ rights they have. A landlord who offers a buyout is literally purchasing a tenant’s future rights to the unit.

Landlords offer buyouts to tenants for several reasons.

A couple of years ago when property was hot, developers bought buildings to turn them into TICs with the eventual plan to convert the units to condominiums. A TIC (tenancy-in-common) is a shared ownership of a building. In these cases developers sell shares in a building. Each of the shares includes a right to exclusively occupy a given unit in the building. Often developers used the infamous Ellis Act to clear buildings of tenants. I’ll save the sordid history and diastorous consequences of the Ellis Act for another post.

Another scenario occurs when an owner wants to move into a given unit in a building. A landlord could be entitled to evict a tenant using the just cause of owner-move-in eviction (OMI). In San Francisco an owner must jump through several procedural hoops and have the intent to live in the unit as his principal place of residence for three years.

Sometimes landlords are out and out lying about their intentions. They serve Ellis notices and OMI notices as a pretext to evict rent-controlled tenants to simply raise the rents. As you can imagine, there have been many documented abuses of these landlord rights resulting in many wrongful evictions. But unfortunately there are many other tenants who shrug their shoulders and move.

If you are offered a “cash for keys” buyout by a foreclosing bank or a sleazy real estate agent who claims to represent the bank, never take it unless you consult with an attorney or a tenants’ rights group.

Finally there are landlords who offer tenants buyouts just to get them to move to raise rents. Think the notorious CitiApartments and their tactic of tenant harassment with buy-out offers ten times a day. You should almost never consider a buy-out when you are offered one by a big landlord you know can’t even come up with a pretext to evict you.

When can you expect a buyout?

Usually buyout offers come with changes in ownership. A new landlord purchases the building or the greedy children inherit the building from your nice old landlord who immediately made repairs when you requested them and who brought you cookies at Christmas. If there are no changed circumstances in ownership a buy-out offer can indicate a landlord’s future intent to sell the building.

Most legitimate buy-outs are offered to tenants in buildings with six units or less in San Francisco because condominium conversion is prohibited in buildings with more than six units.

Get as much information as you can about the landlord.

Like almost all other decisions you will make regarding your tenancy, this is a business decision. Gather as much information as you can. Talk to other tenants in the building to see if they have been approached by the landlord. Has the landlord evicted tenants like this before?

In one case we represented a long-term tenant with an OMI threat from the landlord. He did excellent research and found that the landlord had served an OMI notice to another tenant in another building a year previously. Clearly the threat to our client was bogus because the landlord couldn’t live in two places at the same time.

So take some time to find out what other properties the landlord owns. Property ownership is a public record available through the Assessor-Recorder’s office. Does the landlord claim he wants to move into your one-bedroom, when in fact, he lives in a mansion in Forest Hills? You want to know this before you negotiate.

Eviction notices are also filed with the San Francisco Rent Board. Sometimes you can determine a landlord’s true motives by understanding his past eviction pattern.

Think it through and do the math.

Remember, if a landlord tells you he’s thinking of moving in or removing all the tenants in the building using the Ellis Act, in San Francisco, you will be entitled to relocation payments pursuant to Rent Ordinance §37.9C—as of this writing, approximately $5,000 per tenant up to three tenants, $3,300 for each disabled or elderly tenant and $3,300 for families with minor children. Check the linked chart. Notice that Ellis payments and qualifications are slightly different. That’s your bottom line. If the landlord offers less, he’s a Cheese Ball, too cheap to hire a lawyer and too stupid to read the law.

Next, think about the additional rent you will be paying if you move. You should factor that in, especially if you think the landlord might be offering you a buyout because the eviction threat is a pretext.

Finally think about how much time you will need to find another place to live and remember the more time you request the less money you will be offered.

Citistop, the tenants’ organization that played a huge role in the demise of CitiApartments, has some very good advice about buyouts from the perspective of tenants whose landlord never had a basis to evict them.

Tenant buyouts, especially those designed to empty units for TICs, deplete rent controlled housing stock. Yet, in some cases, notably Ellis Act eviction threats or quasi-credible OMI eviction threats, a tenant may not have any defenses to a future eviction if they stay and fight it out.

For some tenants, a buyout may be preferable to suing for wrongful eviction in the future, especially if the landlord’s rationale to evict may be sound. I believe it is extremely important to develop a strategy that considers all of your options and all of the pitfalls before you negotiate a buyout.

I may have to leave SF anyway – but- is there a way I could get my landlord to “buy me out” anyway ( I have great rent control and he would make his money back in 2 months)